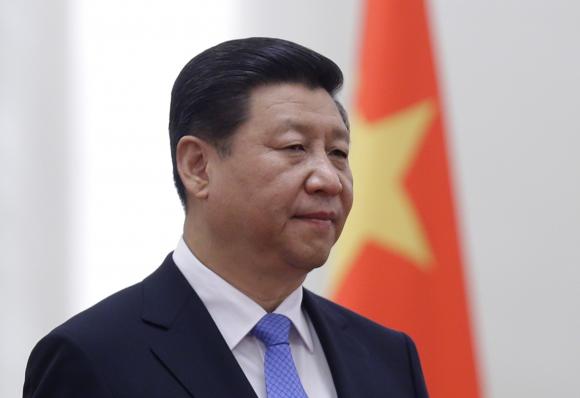

Beijing - Chinese authorities have drawn on their war chest of foreign currency reserves to support the renminbi as it approaches the Rmb7 per US dollar threshold. After peaking at nearly $4trn in mid-2014, China’s reserves are now below $3trn, which has led to tighter government controls on capital outflows and increased scrutiny of overseas investment projects. Chinese officials will have to decide whether it is more important to continue to support the renminbi at the expense of the country’s reserves, or whether they should prioritise the reserve level and allow market forces to determine the level of the currency. “At the Asia Pacific Economic Cooperation summit in November, president Xi Jinping offered China’s answer to the TPP, the Regional Comprehensive Economic Partnership (RCEP) – which intentionally excludes the US – and spoke of broadening the free trade area of the Asia-Pacific. “Although the RCEP may not be as ambitious as the TPP in reducing nearly 18,000 tariffs and trade barriers, it is the only major Asian trade deal that is up for negotiation.” “At 19 cases, the US has the most trade disputes with China at the World Trade Organization (WTO). Under the WTO safeguard agreement, president Trump can impose temporary tariffs on certain Chinese products, which will most likely be the products currently under dispute [these include steel, aluminium and coal]. “A decision to impose additional tariffs outside the WTO’s scope would violate the existing trade agreement with China, which is likely to cause that nation to retaliate by cancelling its US-bound exports and substituting its imports of US goods with those from other countries.” Another large currency devaluation by China’s central bank could strengthen Mr Trump’s depiction of the country as a currency manipulator. It is also likely to cause other Asian countries to depreciate their currencies, resulting in a domino effect across the region. Although China is likely to feel the effects of weaker trade under a Trump presidency, it may benefit from the US withdrawal from the 12-nation Trans-Pacific Partnership (TPP) as the country was previously excluded from the scuttled deal. With its share of global GDP surging from 4 per cent in 2000 to 15 per cent in 2015, China is positioning itself to assume a greater role in promoting regional and global trade agreements and the free flow of investment. China has already surpassed the US as South America’s largest trading partner and has pledged to increase trade to $500bn and foreign direct investment to $250bn by 2025. President Xi Jinping has opened the possibility for Latin American to join China’s One Belt, One Road programme, a modern version of the Silk Road linking Asia to Europe.(FA)